Family businesses: one model, three circles, seven territories

Family businesses: one model, three circles, seven territories

When we think of family businesses, the diagram that naturally comes to mind is that of two circles: the family and the business. The interaction between these two systems creates a particular dynamic that makes a family business unique. This is both a strength (involvement of the manager, long-term vision, etc.) and a weakness (risk of tensions between family members or within the company affecting relations between individuals).

This two-circle model had its limitations, however, because it did not take into account the dimension of share ownership. This led to the emergence of the three-circle model at the end of the 70s, which added the shareholder circle to that of the company and the family.

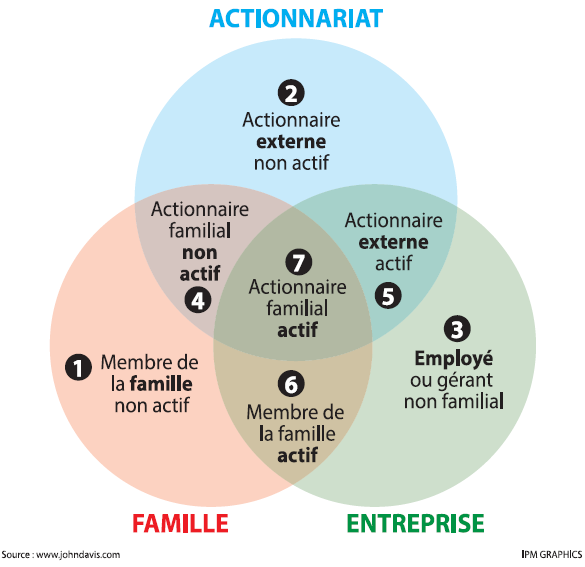

The seven territories. It is by creating overlaps that the system takes on its full meaning. The overlap between the three circles forms seven distinct zones (or territories) which allow us to appreciate the different points of view of family members, shareholders and company employees, which can be summarised as follows:

- The non-active family member has ambivalent feelings towards the company. This may be the manager’s wife or another family member. Both the company’s survival and family harmony are important to them. How do you strike a balance between family life and the prosperity of the business?

- The concerns of the external shareholder (the investor) are financial. What will my return be? Am I getting enough information? How will I get out of my investment?

- The non-family employee, who may occupy any type of position in the company, is mainly concerned about job security and career development. Is there a risk that nepotism will limit my opportunities for advancement? Will my merits be rewarded?

- The non-active family shareholder, who can be described as a “patient” holder of capital, shares the concerns of groups 1 and 2.

- The active external shareholder, such as an executive who has obtained shares as a reward for his merits, is concerned about the company’s prosperity while sharing the questions asked by group 2.

- The family member who works in the company without owning shares is also concerned about his or her career while taking an interest in the family arrangement. They may also aspire to become shareholders.

- The active family shareholder – often the director, but sometimes other people too – represents the interests of all the groups. As they wear many hats, they have to take account of the expectations of all three circles, while taking care not to exhaust themselves.

The circles are dynamic. These three circles are not static. A person can change territory over time. For example, a child may become a shareholder by inheritance and become active (or not) in the company. And the shareholder-manager, when he finishes his career, may become a non-active shareholder or withdraw from shareholding altogether. The size of the circles may also change over time. Certain circles may become more important, e.g. if the family grows and the company can no longer provide work for everyone, or conversely if the company becomes very large and few family members are involved.

This model has proved its worth. Since it was published over 40 years ago, the three-circle model has become a benchmark. Widely taught in business schools, it is appreciated for its simplicity, while at the same time making it possible to conceptualise a large number of situations. The neutrality of the model helps to defuse tensions in family businesses because everyone can recognise and understand the interests of the other stakeholders, which are also legitimate. What’s more, it’s fascinating to note that you can almost predict how a person will behave simply by belonging to one of the territories.

(*) The three-circle model of the family business was developed by Renato Tagiuri and John Davis at Harvard Business School from 1978 onwards. For more information, visit www.johndavis.com

Tanguy della Faille

Managing Partner, FB Transmission